The modern era shows an ever increasing degree of solid and meaningful networking between people (and businesses alike) across the globe. Not only does this amount to the building of external relationships, but of relationships as a whole. The ‘interconnectedness of all things’ is an idea thought of as true by a number of leading business relationship experts – such as French et al. The effective management of business relationships is a critical success factor in maintaining a working competitive edge over an industry. Network connections between parties of people are more important than ever before in ensuring widespread and lasting prosperity.

Interconnection between businesses and the people working within them can vary in nature depending on stakeholder-status. Stakeholders are generally broken down into internal (owners, employees etc), external (governments, trade unions etc) and marketplace (customers, competitors, suppliers etc). You would not build a relationship based on the same practices and ideas when comparing employees and competitors, for example. Yet a relationship of some description is useful in both areas.

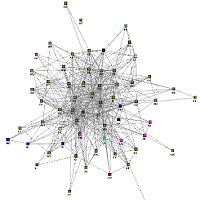

- Nodes in a Network

Business networks are comprised of nodes (each node representing a point of contact), and the relationships that connect these nodes together. Such networks can become highly complex and intricate, particularly when certain members of a network overlap connections with others.

Although connecting with stakeholders through a meaningful relationship is now easier than ever before, with thanks primarily to the onset of widespread online communication technologies, managing said relationships in a proactive and beneficial fashion is still of importance.

Simply opening a Twitter account, following relevant members and hoping to reap the rewards of shared information does not amount to an effective relationship. Rapport between parties involves useful input from all members of the group, adding to the shared value of networking with others. It would be foolish to underestimate the power of networking, particularly in the early stages of business.

Ben Way, one of the UK’s leading young entrepreneurs (with a feature on Channel 4’s Secret Millionaire), solidifies the importance of networking and interconnectedness in this recent post on In A Fishbowl.

Even if you’re up against it with deadlines or working flat out on your business, continuing to build networks is so important.

If you feel you could benefit from a relationship with Netwise Hosting, and have something meaningful you wish to share, feel free to contact us by clicking here. We would be happy to discuss such avenues of business. In the mean time, our affiliates/reseller programme can provide a base-level relationship with us, founded on the shared interest of product sales.